The S&P continued toward my target in the 1600 area, in fact I believe it hit the 1.618 Fibonacci move today and could retrace from here. Several indicators of that possibility. It is way beyond its upper Bollinger Band, it is possibly forming its third bearish divergence against the Ergodic momentum indicator, and it has touched and turned back at the top of the up channel as you can see in the chart. Another cautionary item to note is the non-confirmation by the Nasdaq 100 and the Russell 2000, neither making new highs here. Soooo I would make an educated guess that the market will find some reason to pull back from here. Now how big of a correction … I don’t know but May is right around the corner and statistically it has been wise to sell in May and go away. The market is setup for this classic traders almanac rule of thumb, to come true this year. On the other hand, the Fed is a long way from ending its QE so this market is in no way normal. In fact, its an example of the new normal.

Tag: S&P

Weekly Indices are all up, up and away!

The S&P is 25 points away from its all time high at 1576, so it has yet to confirm the Dow record. However it put in a strong week and other than the ADX which is giving a cautionary signal, all seems well. The markets are up, not because the economy is so great but simply because the Fed keeps giving money the favored banks and they in turn inject it into the market since the rates are so low, bonds are not the place to be.

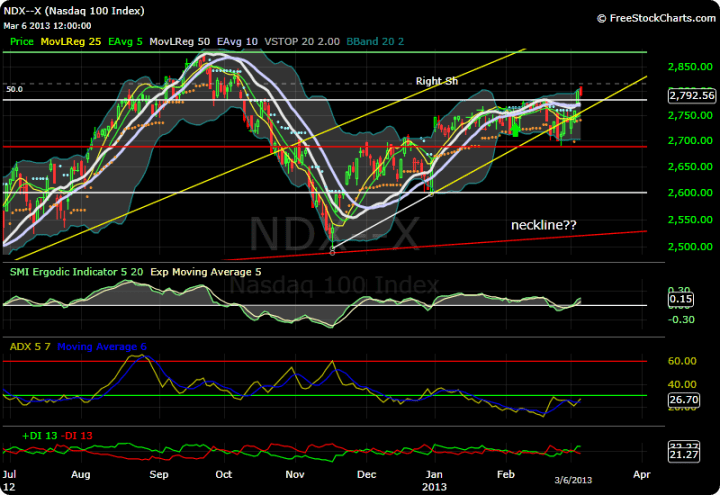

The Nasdaq definitely has not confirmed the dow record high but is way behind its 2000 record high. In fact it has yet to take out its Sept. 2012 high of 2878, which until it does, I consider that to be the head of the possible head and shoulders bearish formation. It is basically chopping around sideways with little momentum. Apple of course is a big drag on it, breaking below 400 this week for the first time in over a year.

The small caps measured by the Russell 2000 has confirmed the Dow and is making new highs. For a while I thought this was going to lead the pack down, however, it took off and has been leading on the upside. The only caveat here is the ADX roll over above the 50 mark. It has yet to cross over its moving average, but often this will precede a trend change by 1-3 weeks.

Other Stock Indexes Lagging the Dow

Even though the Dow has made new highs, and looks quite strong here at around 14,300, the S&P still has to exceed 1576 to take out its highs and its just at 1541. This lack of confirmation by the other indices is a bit of a warning not to be too exuberant and protective stops would be in order.

The Nasdaq 100 is nowhere near its highs of 4816 in March 2000 but more importantly its not even taken out its highs from last September 2878 and seems to have fallen back when it stuck its nose above 2800, closing today at 2792. The weekly chart still looks like a big Head and Shoulders pattern, quite bearish.

The Russell 2000 small caps has made new lifetime highs a couple weeks ago, but on this latest rally it has not been able to break above those and on a weekly chart it looks like its getting an ADX peak sell signal. This could come about in weeks or days but it will result in some sort of pull back.

Bearish indication of last week coming true

Last week I posted that the Russell 2000 was foretelling of an upcoming bear move. Generally small caps lead the way. After a bounce Friday to the 50/10 LRCs and giving the 25/5s time to cross below the 50/10s, the market is now resumed its down move. There was a bounce this morning but it was stopped at all the various resistance points. A great shorting opportunity.

On the SP the next support is at 1475 area where there is an uptrend line coinciding with previous resistance. Also the weekly charts have not yet broken down. it could rebound off this level.

Continue reading “Bearish indication of last week coming true”

Continue reading “Bearish indication of last week coming true”

Market Indexes at 2/1/13

Dow: On a long-term basis looking at the monthly charts .. all is bullish, with a couple of caveats. Its nearing the previous high of 14,198 but has yet to take it out. The ADX is not showing a strong trend, as compared to say 06,07,08 since it’s under 30. It hasn’t tagged the upper Bollinger bands since early 2011, a failure to do so is a strong indicator of waning momentum. So we need to see what happens in February.

The weekly charts dow chart, however, has all indicators pointing up. Pushing the upper BB channel, strong Ergonomic, trending ADX but not overbought. Continue reading “Market Indexes at 2/1/13”

Jan 29, 2013 Consumer Confidence drop

The Conference board reported that consumer confidence in January dropped to lowest level since Nov. 2011. I find this interesting in light of the stock market nearing its all time high (S&P high was 1576 in 2007). Also in light of the rising retail sales numbers. Maybe fear brings about escape through spending. The stock market is up because the Fed keeps pumping cash into the system and keeps interest rates near zero. Also because there seems to be that bubble mentality brewing.

Look how the stock market used to move in tandem with confidence and how its now diverging dramatically.

Next look at how retail sales are strong yet confidence is weak. The sales figure, however, lags the confidence I believe.

And lastly here you can can see the historic consumer confidence levels for the past 6 years. The top part of the graph is actual CC numbers and the bottom shows rate of change. Now it has obviously turned negative and is accelerating to the downside in velocity but will it really plunge or bounce up from here? Who knows, but it will be interesting to see if next month shows a trend. Also there are several measures of this, we have to see if they all confirm.

Update 2/1/13

The Univ. of Michigan consumer confidence came in at 73.8 up from 72.9 in Dec. so go figure… Amazing how these different polls vary and who knows which one to trust. Also today, the unemployment rate rose to 7.9% but more importantly only 157,000 jobs added which is pretty weak. On the other hand the total added jobs for 2012 was increased up 335,000

SP 500 at 1/18/13

The S&P appears to be on its way toward 1576, the high in 2007. Looking at the daily and weekly charts, everything is pointed up and now that it took out resistance at the Sept. 2012 highs, and the debt ceiling issue has been put off for 3 months, or appears to be… I don’t see much to stop it. The ADX is not in overbought territory so there most likely wont be a pull back for a while yet.

And on a weekly basis all indicators are pointing up, what appears to be the beginning of an uptrend. I would not want to be short the mkt here. Definitely not overbought territory.

Post Xmas Selloff

The market sold off a bit today, once again “fiscal cliff” worries. Continue reading “Post Xmas Selloff”