The S&P is 25 points away from its all time high at 1576, so it has yet to confirm the Dow record. However it put in a strong week and other than the ADX which is giving a cautionary signal, all seems well. The markets are up, not because the economy is so great but simply because the Fed keeps giving money the favored banks and they in turn inject it into the market since the rates are so low, bonds are not the place to be.

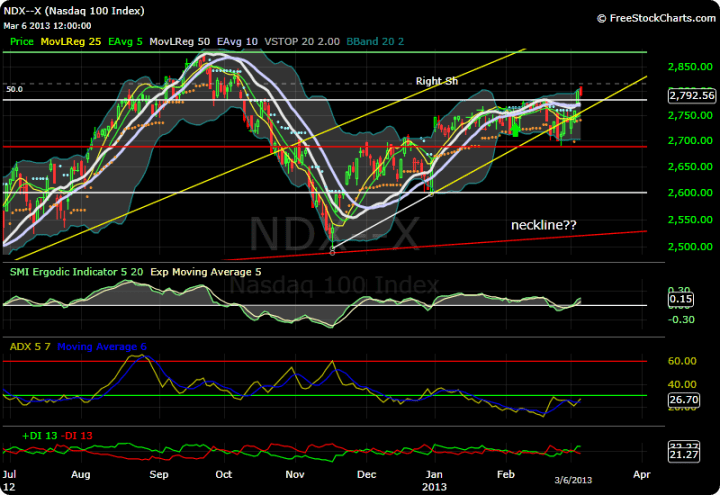

The Nasdaq definitely has not confirmed the dow record high but is way behind its 2000 record high. In fact it has yet to take out its Sept. 2012 high of 2878, which until it does, I consider that to be the head of the possible head and shoulders bearish formation. It is basically chopping around sideways with little momentum. Apple of course is a big drag on it, breaking below 400 this week for the first time in over a year.

The small caps measured by the Russell 2000 has confirmed the Dow and is making new highs. For a while I thought this was going to lead the pack down, however, it took off and has been leading on the upside. The only caveat here is the ADX roll over above the 50 mark. It has yet to cross over its moving average, but often this will precede a trend change by 1-3 weeks.